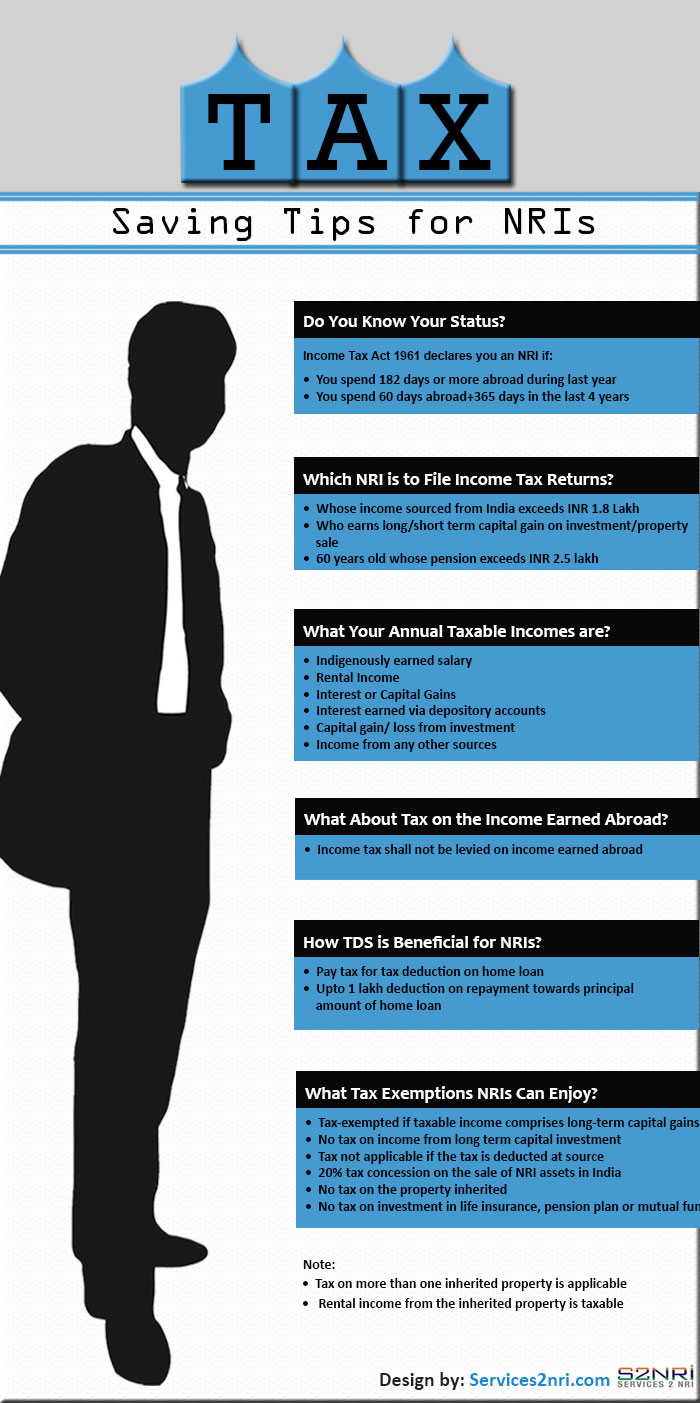

An NRI is the one who spend 182 day or more abroad or 60 day plus 365 day in the last 4 years. The community of NRIs seeks tips for tax saving in India. It’s clear cut approach that migrants have to pay income tax if his/her indigenous income exceeds INR 1.8 lakh annually. The elder ones above 60 years of age have to file for tax if their pension income exceed more than INR 2.5 lakh. Rental income, salary, interest on capital gains, interest on depository account and capital gain/loss on investments are parked under taxable income. The income sourced from abroad is non-taxable. Tax deduction at source (TDS) can be advantageous when they seek home loan. Upto 1 lakh can be redeemed while repaying against principal amount of home loan. Income from long term gains and investment as well as inherited property is non-taxable. 20% tax concession can be enjoyed by NRI on the sale of their asset. Investment in property through home loan, life insurance plan, mutual funds and pension scheme can exempt them from paying it.