India is an agro-based country since approximately 70% of its population earns bread and butter through farming. But farming is not the only composition of agricultural income. There are many associated works that generate income, like renting out the agro-land. This facility is available for the natives of India. But an NRI can’t invest in the purchase of agriculture land or farm house in India.

Read MoreTag: tax rules for nris

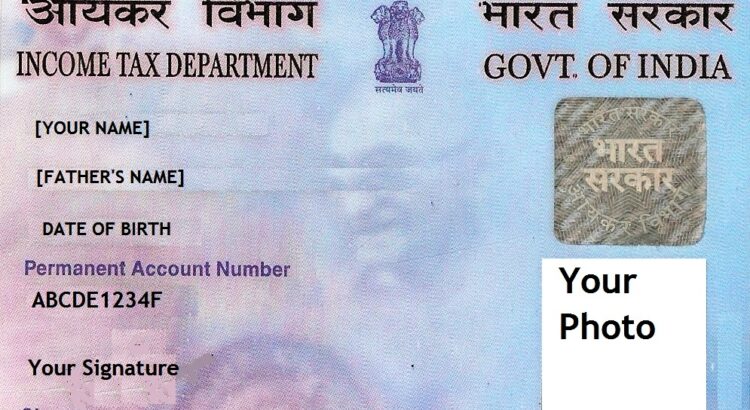

PAN Card Not Mandatory to Pay Tax by NRIs, OCIs & PIOs

NRIs, PIOs and OCIs are battling to swap junked currency after demonetization. Now, Reserve Bank of India (RBI) has given a new lease to them. The date to swap outdated currency has been extended upto 30th June, 2017. By showing their valid identity & source proofs along with the letter/form of authority, they can easily exchange the defunct notes at any branch of RBI.

Read More

NRIs without PAN Will Not Be Charged Higher TDS

Indian diaspora is scattered across the globe in big count. Alone, Germany houses 35000 NRIs. In Switzerland, this count is estimated around 13,500. And this figure jumps upto 2,226,585 in the US while in UK, it’s 1,051,800. A mammoth part of Indian population lives abroad. Many of them are still connected to their roots here. Property investment, their capital investment in shares, NPS and other finance schemes paint the apparent picture of their firm connectivity.

Read More