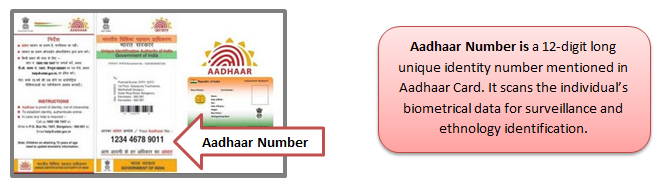

Do you have Aadhaar Card?

Have you linked it to your mobile phone number and bank account?

The ruling Indian government is strictly adhering to the amended rules. A lot is happening in the rule books of Aadhaar Act. When this Act was composed, it was uniform for all. After demonetization, its linking to bank account emerged as the need of the hour. Transparency in transactions became immediacy.

What could the Indian government do then?

The stalwart composers of constitution introduced a law.

It directs: Link Bank Account with Aadhaar Number.

This mandatory direction would cease the banking services of those residents who would fail to connect till the below mentioned deadline.

Deadline: 31st December, 2017 (being the last date to connect pan card with the aadhar number, it will a huge rush….Phew!)

Result: 1.171 million native Indians enrolled for Aadhaar Card till Aug, 2017. With these figures, the overall population of this card holder touched this count-1,144, 659,906. It’s around 87% of the total population.

It’s really a praiseworthy figure!

The execution of this Act started stirring confusion all around. For NRIs, PIOs and OCIs community, the linking of this card became a threat.

What confusion?

Answer: Millions of NRIs don’t have their Aadhaar Card. They don’t have access to this facility. However, there are a few ones who have enrolled in this NRI service. But they did so when this card came into existence. This Act was different. There was no separate provision for the non-residents of this country. So, many of them got enrolled.

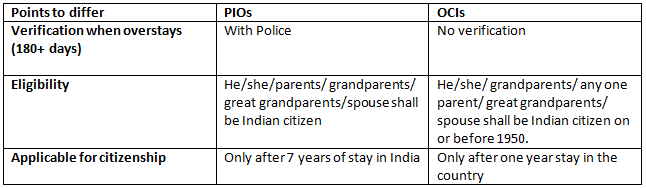

This Act was revised in 2016 which deleted pervasive confusion amongst the expats of Indian origin.

Many of them have enrolled even after execution of this edited Aadhaar Act. Although it was a hard nut yet they cracked it by hiding their foreign residential profile. They mentioned Indian residential address in the form. But it’s an unfair practice.

Here is the copy of the disclosure that the Aadhaar card enrollees sign. They submit it with their application form.

Having no Aadhaar Card can trouble OCIs or NRIs who:

- Continue to operate their resident bank account in India for various reasons. Its cause can be deposited pension or any other one.

- Hide their non-resident status of the resident banks.

Solution: Carrying on banking in the resident bank account is an illicit practice. The legislation terms it a clear violation of its rules. Therefore, the expats ought to discard such services to NRIs/OCIs. They ought to notify the banks about their foreign status.

What if the OCI or PIO has not linked his bank account with Aadhaar number?

PIOs and OCIs hail from non-resident of India group. Those who got their Aadhaar number concealing their NRI status, they must notify the bank. Doing so will keep them away from potential problems. Conducting such practice is apparently the breaching of Aadhaar Act, 2016.

If the confusion still persists, you should notify these facts:

However, the expats of this origin have banking rights. They can carry on transactions through NRE or NRO accounts. It would be legal.

It’s obvious that such community can’t have this number. The bank authority understands this fact. Therefore, it will not put any roadblocks between NRIs & banking services.

Basically, PAN card is a requisite document when you file for tax. The government has put a deadline for its holders to append it to the Aadhaar number. Its last date is 31st August 2017. If the one, somehow, fails to do so, he/she has to face problems in paying tax.

NRIs also pay tax. The revenue or income generated through Indian resources is taxable. Such expats should not be worried. They can’t apply for NRI services, like PAN Card and Aadhaar Card. Therefore, there seems no logic behind such worries. They can pay tax through Form-60 rather than using PAN card.